ALTERNATIVE INVESTOR STRATEGY

This website monitors and analyzes the behavior of four major financial markets:

_ The broad U.S. stock market (the DOW, S&P 500, and NASDAQ market indices)

_ The price of crude oil

_ The price of gold and silver

_ The value of the Swiss Franc relative to the U.S. Dollar

Alternative Investor believes that a carefully managed portfolio of investments based in these four markets is a simple and ideal strategy to preserve capital and generate profit in current economic times. Please note that this does not mean I believe all of these markets are on their way up at this time (some are, some are not). They are, however, markets that have been making and are expected to make large moves (up and down) in the near future and afford us the opportunity to make profitable trades either by buying low and selling high or through short selling (making money when the market moves down).

GOLD, SILVER, and the BROAD U.S. STOCK MARKET

All financial markets move in cycles, both short-term and long-term. According to the sources I study, we are now (2013) in a cyclic period of time when precious metals (gold and silver) are generally bullish (i.e. increasing in value) whereas the broad stock market (as measured by indices such as the DOW or S&P 500) is nearing the end of several LONG-TERM cycles and is IN THE PROCESS of making a long-term cycle top which should be followed by a severe long-term correction. We could see that top fairly soon, but it's also possible that government intervention (QE - "quantitative easing", near zero interest rates, dovish fiscal policy) could stimulate equity markets and delay that final top for at least several more years. Please note that I am writing this in 2013 - well after the 50% correction of the DOW in 2008-2009. The markets at this point have almost totally recovered from that crash. Nevertheless, according to cycle timing and other technical studies, it is very possible that another more severe correction is looming in the not too distant future, and the DOW could plunge again (and likely not bounce back quickly as it has been doing over the last three years).

What this means in practical terms for traders and investors is that we have a cautious eye on any rallies in the broad stock market.

We may buy into these rallies short-term, but we are ready to pull out and sell short when the cycles and technical studies indicate big downward moves.

In contrast, we have been generally bullish on gold and silver but may also sell these metals short at times when corrections occur (as they do in all markets - bullish or bearish).

UPDATE (September 2020): The broad stock market has continued to rise due to dovish Federal Reserve policy (QE- quantitative easing and ZIRP- near zero interest rates). This has resulted in an extremely overbought equities market that many analysts now characterize as a "bubble".

It is possible that the bottom of the 2008-2009 crash was a final long-term cycle bottom that won't be revisited for some time; however, equity markets could still experience another 50% or greater correction from their current overbought levels, and because the Federal Reserve has "maxed out" its ZIRP and QE, a recovery from such a crash could be slow. Gold and silver prices were relatively flat from 2015 - 2019, but this year has seen a steep rise in both metals, with gold reaching a new all-time high of $2070 in early August. It is getting late in a longer-term (23 year) cycle in gold, so this high may have been a significant peak. Short-term traders should probably consider standing aside both gold and silver for now, as prices could correct down a bit from this recent high.

UPDATE (December 2021): The broad stock market's "irrational exuberance" continued this year - driven by government stimulus, dovish fiscal policy, and sustained near zero interest rates. But it seems like this party may soon be coming to an end. The Federal Reserve has already begun tapering its bond purchasing program (QE), and they are now declaring that benchmark interest rates are about to rise. COVID-19 fears may be subsiding, but even if they rise up again with new virus "variants", the government will not likely be able to cough up much more COVID "relief" stimulus money. Furthermore, a medium-term cycle in equities is due to peak soon (by late Dec. or possibly early 2022), and that will most likely also be the top of some longer-term cycles and should be followed by a severe long-term correction in the broad stock market. That correction should be at least 10-15%, but it could also get to around 20%. There is also the possibility that this market is about to complete a VERY long-term 90 year cycle by 2024. If that's the case, we could see a correction of 70% or even more over the next several years. Needless to say, it looks like it is time for all traders and investors to either get out of the market or start looking to sell it short.

CRUDE OIL

The value of basic utilitarian commodities such as crude oil and copper usually follows the general condition of the economy (or sometimes the perceived condition of the economy as indicated by major stock market indices like the DOW). This is because it is generally thought that a slumping economy will not use as much oil and raw materials as would a vibrant one. (There are exceptions to this with oil, however, as during times of instability in the Middle East when the price of oil can soar up or plunge down in very short periods of time independent of the DOW.) Crude oil prices dropped dramatically in sync with equity markets during the great "recession" of 2008-2009, but crude currently (2013) has significantly recovered from that plunge. If another major drop in the broad stock market should occur, we would expect the price of oil to fall as well. Prior to this, however, there should also be tradable upward rallies which can be taken advantage of (cautiously, as with the stock market).

UPDATE (May 2016): The rebound in crude oil prices after the 2008-2009 crash was not as strong as the recovery in the broad stock market, and from late 2014 through 2015 crude tumbled again and sank below its 2009 lows even as equity markets pushed higher (although the DOW did take a sharp 15% correction in Aug. 2015). Crude's plunge could be a message to Wall Street that despite corporate profits, all is not well on "Main Street". Crude may now be close to starting a new long-term cycle which means that prices could be bullish in the short to medium-term. The longer-term trend has yet to establish itself and will be influenced by what happens in the broad stock market (and vice-versa).

UPDATE (December 2021): Crude prices rallied a bit in 2016-2017 but started falling again in 2018 - 2019. In April 2020, crude prices made a dramatic and historic plunge temporarily below zero. This was caused by the "perfect storm" of a global supply glut and a sudden lack of demand due to COVID-19 lock-downs. The "near zero" low of that April 2020 correction was most likely the bottom of several longer-term (36-year, 18-year, 9-year) cycles in crude. This means that this market could be quite bullish now and for some years to come as we are at the starting point of three new long-term cycles. Prices bounced back quickly from this plunge and have now (Dec. 2021) rallied back to around $70 confirming this bullish trend. Despite this likely long-term upside trend, there are also shorter-term cycles that will rise and fall. In other words, crude prices will not just go straight up. As with all markets, there will be short-term corrective dips along the way.

The SWISS FRANC and U.S. DOLLAR

UPDATE (May 2022): A LOT has happened since I wrote the discussion below on the Swiss Franc and U.S. Dollar in 2013. At some point I will discuss this a little more, but for now I will say that we have been avoiding any currency conversion as the U.S. Dollar's value has been quite strong over the last eight years (although that COULD be coming to an end fairly soon). Please refer to my recent blog posts where I discuss the long-term cycle and political cycle of the U.S. Dollar Index. These posts were on April 9, 2022 and April 27, 2022.

Jan. 2013

In our unstable economic times the value and security of the U.S. Dollar can clearly be at risk.

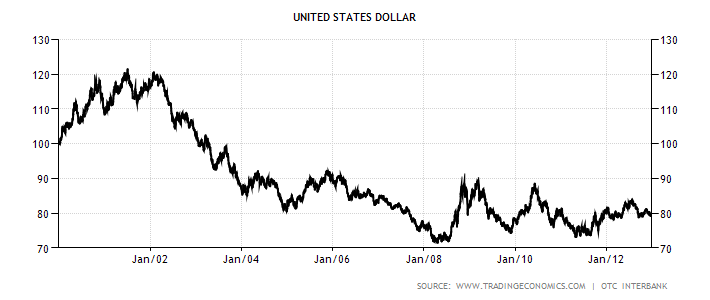

A quick glance at a chart of the U.S. Dollar Index over the last 10 years (Jan. 2002 - Jan. 2012) is rather alarming and shows a steep and persistent downtrend. The Alternative Investor strongly recommends all traders and investors place some portion of their funds into a "safety account" - an FDIC insured savings or money market account with a financial institution that allows you to convert your money into a currency of your choice at any time. During times when the U.S. Dollar is falling, one can then protect the value of their savings by switching into a more stable currency (such as the Swiss Franc) and then moving it back into U.S. Dollars when the dollar starts to rise again.

Currency values move up and down in cyclical and technical patterns very much the same as equity and commodity markets and can be analyzed in similar fashion for bullish and bearish trends. Please note that The Alternative Investor attempts to identify relatively long-term currency trends and does not recommend switching currencies frequently. We do this mainly to preserve the value of our "safety" dollars and to generate a small profit (the result of converting a more highly valued currency back into devalued dollars). This "profit" may be modest but usually far exceeds the abysmal interest rates most financial institutions offer on their savings accounts these days. Again, the main purpose of this safety fund is to have some portion of our money insured and protected from the potential volatility and instability of other markets.